Key Highlights

-

Economic growth is lacklustre, but expectations for the UK remain cautiously optimistic heading into 2025.

-

Capital value declines have slowed, driving positive total returns for UK real estate through the first three quarters of 2024.

-

UK real estate is attractive and expected to maintain forward momentum, particularly in the retail, living and industrial sectors.

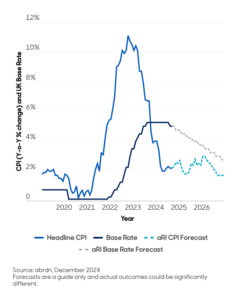

UK inflation rate and Bank of England policy rate forecasts

UK economic outlook

Activity

As expected, economic growth slowed over the second half of the year. The UK’s economy failed to grow over the third quarter and growth was revised down over the second quarter from 0.5% to 0.4%. There was a slight monthly uptick during November, although it was below expectations. Changes to business rates and National Insurance contributions aim to raise additional revenue to fund Labour’s growth-centric agenda. But this has been met with shrinking fiscal headroom, as borrowing costs remain under pressure. Indeed, a sell-off in the gilt market at the start of 2025 threatens future spending commitments and questions Labour’s ability to meet its own fiscal rules.

The all-sector Purchasing Managers’ Index stood just above the level of contraction at 50.6 in December, as business confidence has been shaken since mid-2024. Manufacturing led this decline, although key budget-related elements will weigh on the services sector in 2025.

Inflation

The annual Consumer Price Index unexpectedly fell to 2.5% in December, primarily because of a decrease in the price of restaurants and hotels, clothing, and alcohol and tobacco. Crucially, the uncomfortably sticky services inflation component decreased to 4.4%, well below the expected 4.8% increase. With the labour market also showing signs of cooling, the latest inflation print is welcome news for a central bank trying to avoid a hard landing. However, a January 2025 British Chambers of Commerce quarterly survey indicated that over half of businesses are planning to raise prices in the next three months, given rising labour costs.

Policy

After cutting 25 basis points (bps) in November, the Bank of England voted six to three in December to hold the policy rate at 4.75%. It continued its hawkish commentary, citing “global and domestic uncertainties”. At the time of writing, an additional four quarter-rate cuts over 2025 are still officially on the table. A close eye will be kept on wage growth, which remains high. We expect caution to be exercised here, given upside risks to services inflation and potential ramifications from the US government. Still, December’s split vote suggests an appetite for further policy easing in the near term. This could increase in pace during the second half of 2025, once uncertainties have been worked through or if growth struggles more than expected.

Read more here: UK Real Estate Market Outlook Q1 2025.